Chinese EVs Surge in Europe as AD Tech Hits Milestone

Chinese EVs overtook Korean rivals in Western Europe for the first time in September 2024 with 8% share and 77.5% YTD growth, defying EU tariffs. Tesla's FSD V12 unlocks end-to-end AD potential, while TTTech's MotionWise accelerates SDVs. This combo signals China's dominance in global EV and autonomy markets.

In a pivotal moment for the Chinese electric vehicle (EV) industry, September 2024 marked the first time Chinese carmakers outsold Korean rivals in Western Europe, capturing an 8% market share amid fierce competition. This breakthrough coincides with groundbreaking advancements in autonomous driving (AD) technology, highlighted by Tesla's FSD V12 paradigm shift, and new software tools accelerating software-defined vehicles (SDVs). Despite looming EU tariffs, Chinese brands like BYD, XPeng, and Chery are expanding aggressively, signaling a transformative era for global EV markets.

Chinese EVs Conquer Western Europe: Sales Data Breakdown

Chinese EV manufacturers achieved a historic milestone in September 2024, surpassing Korean competitors (Hyundai and Kia) in Western Europe for the first time. According to Schmidt Automotive Research, Chinese brands hit 8% market share versus Korea's 7.8%, with year-to-date (Jan-Sep) sales reaching 503,321 units—a staggering 77.5% year-over-year surge, dwarfing the region's 1.1% overall market growth.

Despite EU anti-subsidy tariffs on Chinese pure EVs starting October 2024, Q3 saw Chinese models double in availability. Here's a comparison of key players' EV shares in Western Europe (front 10 months 2024):

| Manufacturer Group | Pure EV Share | Total Market Share |

|---|---|---|

| Chinese EVs | 37% | ~7% (Oct: 6.8%) |

| Korean (Hyundai/Kia) | 20% | ~7.2% (Oct) |

| Japanese | 4.3% | 12.5% |

- Key drivers: "Group army" of brands (BYD, Chery, GAC Aion, XPeng) versus Korea's duo; aggressive pricing (import prices down ~$9,000 since H1 2023); shift to PHEVs exempt from tariffs.

- Upcoming expansions: BYD's Denza in 2026, Chery new models, GAC Aion and Changan (Deepal) via Magna in Austria, XPeng SUVs already rolling out.

Analysts like Ferdinand Dudenhoeffer predict Chinese firms will outpace Japan and Korea globally over the next decade, eroding shares from Stellantis, Tesla, and Japanese giants lagging in pure EVs.

Autonomous Driving Revolution: FSD V12 as the Game-Changer

Horizon Robotics' Su Qing, fresh from HSD production SOP, hailed Tesla's FSD V12 (2024) as a "watershed" event, proving end-to-end (E2E) neural networks can deliver human-like driving. This shifts from hybrid rule-based systems (pre-2024) to fully data-driven paradigms, akin to nuclear fission's proof-of-concept unlocking atomic energy.

- Historical evolution:

- CMU (2000s): Rule-coded, sensor-heavy.

- Stanford/Google/Waymo: ML for perception only (half-revolution).

- Post-V12: Full E2E for perception, planning, control—solving static (maps) and dynamic issues.

Su Qing warns of hype: No near-term theoretical breakthroughs expected; next 3 years focus on optimization, not another paradigm shift. Challenges remain immense—"intellect and physical double squeeze" from infinite corner cases in the physical world.

Supporting Tech: TTTech Auto's MotionWise for SDVs

Complementing AD advances, TTTech Auto (NXP subsidiary) launched MotionWise Communication middleware on December 11, 2024, unifying cross-domain vehicle comms for SDVs. Deployable on HPCs and microcontrollers, it supports DDS/Zenoh protocols, TSN Ethernet, and all modes (data-centric, service-oriented, signal-based).

Core benefits:

- Safety-certified, deterministic QoS (latency/reliability).

- Cuts integration costs for ADAS/AD, zonal ECUs.

- Enables rapid prototyping to production.

Available Q4 2025 with 3-month trials, it bolsters Chinese OEMs' SDV push amid complex architectures.

Why This Matters: Global Implications for EV Market

China's European inroads despite tariffs underscore manufacturing scale and price competitiveness, pressuring legacy players. Paired with AD/SDV tech leaps, it positions Chinese EVs (BYD, NIO, XPeng, Zeekr) as leaders in affordable autonomy. Japanese firms bleed share due to EV gaps; Koreans hold via networks but face volume onslaught. Long-term: Expect localized production (BYD Hungary 2025) and PHEV pivots to bypass duties.

Looking Ahead: Optimization and Expansion

The next phase isn't explosive disruption but relentless refinement—E2E AD tuning, SDV middleware scaling, and European factory ramps. Chinese EV giants could claim 15-20% Western Europe share by 2026, reshaping global supply chains. Watch for regulatory battles, but tech momentum favors the East.

Original Sources

Related Articles

BYD, XPeng Lead Chinese EV Charge on Pricing Rules, Defamation Wins

China's SAMR unveiled auto pricing guidelines on December 12, 2025, prompting BYD, XPeng, NIO, and GWM to pledge transparency amid EV market turbulence. Courts simultaneously awarded these brands up to $283,000 USD in defamation wins against fake news creators. These moves signal a maturing Chinese EV sector focused on consumer trust and reputation defense.

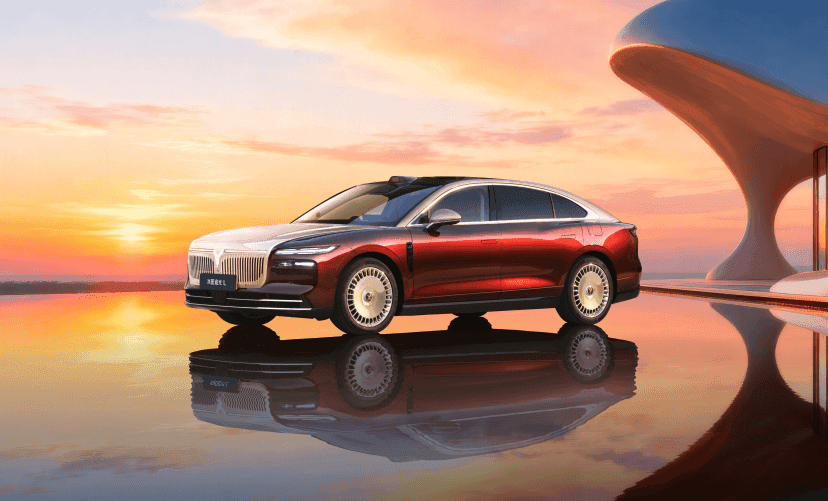

岚图追光L Shocks with 800V PHEV Tech Amid Trade Tensions

岚图's new 追光L 800V PHEV sedan launches at 27.99-30.99万元, crushing BBA rivals with 410km EV range, -25°C fast charging, and Huawei ADS 4.0. Xiaomi adds discounted 'quasi-new' SU7s ahead of 2025 NEV tax cuts, while Mexico slaps 50% tariffs on Chinese EVs, threatening export growth. These moves highlight China's tech edge amid rising global trade barriers.