Chinese ICE Cars Dominate Overseas as Leapmotor Founder Boosts Stake

Chinese ICE vehicles from Chery and SAIC are dominating overseas markets like South Africa (16% share) and Chile (33%), exporting 4.57M units in 2024 amid EV slowdowns. Meanwhile, Leapmotor founder Zhu Jiangming boosted his stake for the third time (HK$108.6M), backing record deliveries of 536k units Jan-Nov 2025 despite a 33% stock drop. This showcases China's versatile EV and ICE strategies conquering global demand.

In a striking display of China's automotive prowess, traditional internal combustion engine (ICE) vehicles from brands like Chery and SAIC are surging in overseas markets, capturing massive shares in regions like South Africa and Chile despite the global EV push. Meanwhile, Leapmotor's founder Zhu Jiangming has increased his stake in the EV maker for the third time this year, spending HK$108.6 million ($14 million) amid a 33% stock plunge, signaling unwavering confidence as deliveries hit record highs. This dual narrative underscores China's versatile strategy in both mature ICE tech and cutting-edge EVs, blending export dominance with domestic innovation.

Chinese Fuel Cars 'Killing It' Abroad: Export Data Reveals Surge

Chinese ICE vehicles are experiencing explosive growth overseas, bucking the electrification trend. According to China Passenger Car Association data:

| Year | Total Auto Exports (million units) | ICE Exports (million units) | ICE Share (%) |

|---|---|---|---|

| 2021 | 2.015 | 1.705 | 84.6 |

| 2022 | 3.111 | 2.342 | 78.2 |

| 2023 | 4.91 | 3.707 | 75.4 |

| 2024 | ~5.85 (est.) | 4.574 | 78.1 |

- Chery leads the charge: 1-11 months 2025 exports hit 1.199 million units, with ~800,000 ICE vehicles (new energy ~30%).

- SAIC close behind: 969,000 total exports, ~500,000 ICE (new energy ~45%).

- Top 10 exporters (excl. BYD, Tesla) rely heavily on ICE for overseas sales.

In South Africa, Chinese brands claimed 16% market share in H1 2025 (up from 10% last year), selling ~30,000 ICE cars vs. just 11 EVs. Chile saw Chinese ICE grab ~33% share, outpacing Chevy, Nissan, and VW (down 34-45%).

Why Chinese ICE Excels Overseas: Price, Config, Reliability

Global EV hype masks realities in emerging markets like Latin America, Africa, Southeast Asia, and the Middle East—scarce charging infrastructure, unstable grids, and demand for rugged, refuel-anywhere vehicles. Chinese ICE fills this gap with unbeatable value:

- Same-price, higher spec: In Saudi Arabia, MG7 (1.5T 185hp, 360° cameras, LED lights, 4 airbags) matches base Nissan Sylphy price but crushes it on power and features.

- Disruptive pricing: Haval H6 in Thailand undercuts Honda CR-V by ~100,000 RMB yet packs large screens, hybrid tech, and local production perks.

Backed by upgraded supply chains, European crash-test standards, and local factories in Thailand, Brazil, Russia, Chinese firms like Great Wall, Chery, Geely, and MG build sales/aftersales networks. Even JVs like Beijing Hyundai and Yueda Kia export 70% from China bases, leveraging cost edges.

Challenges remain: Brand recognition lags Toyota/VW, per analyst Zhang Xiang, but 'Belt and Road' momentum and scale are closing gaps.

Leapmotor Founder Signals Confidence Amid Stock Slump

Contrastingly, in China's EV heartland, Leapmotor (HKG: 9863) founder Zhu Jiangming and allies bought 2.15 million shares at HK$50.51 avg. (HK$108.6M total)—third buy this year (prior: HK$316M April, HK$205M October). They now hold 23.79% of shares, citing faith in 'sustained, stable growth.'

Despite a 33% drop from August peak, deliveries soared:

- Jan-Nov 2025: 536,132 units (+113.42% YoY)

- Nov: 70,327 units (7th straight monthly record)

Leapmotor, backed by Stellantis' €1.5B for 20% stake, raised its 2025 target beyond initial 500-600k after August revision. Models like B01 shine at shows, fueling optimism.

Why This Matters: Global Implications for Chinese Autos

This ICE export boom and EV insider buys highlight China's dual-track mastery—profitable ICE for cash-strapped markets funds EV R&D. Overseas, it challenges giants like VW (planning counter-exports) and GM ('right tech, right cost'). Domestically, Leapmotor's trajectory amid price wars shows resilience.

In a $100B+ Chinese EV/ICE export arena, these moves diversify risks, with ICE at ~78% of exports sustaining profitability while EVs like Leapmotor target Europe/Asia expansion via Stellantis.

Looking Ahead: Sustained Momentum

Expect Chery/SAIC to hit 2M+ annual ICE exports by 2026, with local plants deepening roots. Leapmotor could top 700k deliveries in 2025, eyeing IPO gains recovery. China's auto sector evolves from 'cheap' to 'premium value,' reshaping global competition.

Original Sources

Related Articles

BYD, XPeng Lead Chinese EV Charge on Pricing Rules, Defamation Wins

China's SAMR unveiled auto pricing guidelines on December 12, 2025, prompting BYD, XPeng, NIO, and GWM to pledge transparency amid EV market turbulence. Courts simultaneously awarded these brands up to $283,000 USD in defamation wins against fake news creators. These moves signal a maturing Chinese EV sector focused on consumer trust and reputation defense.

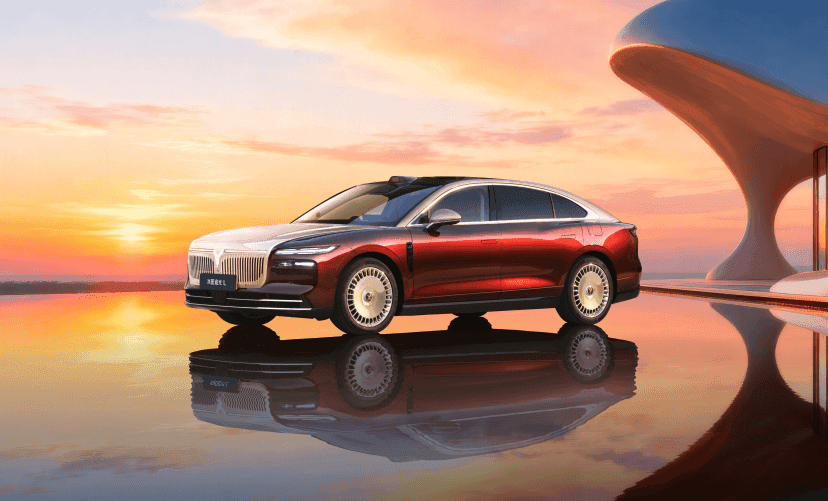

岚图追光L Shocks with 800V PHEV Tech Amid Trade Tensions

岚图's new 追光L 800V PHEV sedan launches at 27.99-30.99万元, crushing BBA rivals with 410km EV range, -25°C fast charging, and Huawei ADS 4.0. Xiaomi adds discounted 'quasi-new' SU7s ahead of 2025 NEV tax cuts, while Mexico slaps 50% tariffs on Chinese EVs, threatening export growth. These moves highlight China's tech edge amid rising global trade barriers.