Xiaomi's AI Leap & BYD's L3 Test: China EV Surge

Xiaomi's MiMo-V2-Flash AI model promises 'living' agents for EVs, while BYD advances L3 testing after 150,000+ km and confirms 16.5% PHEV efficiency gains via OTA. XPeng predicts L4 autonomy soon amid no AI bubble, as Ideal and peers crush smear campaigns. These moves highlight China's EV AI surge against Tesla and global rivals.

In a whirlwind week for China's electric vehicle (EV) industry, Xiaomi unveiled its groundbreaking MiMo-V2-Flash AI model led by new hire Luo Fuli, aiming to create 'living' intelligent agents for smarter cars. BYD kicked off comprehensive L3 autonomous driving tests in Shenzhen after logging over 150,000 km, while real-world data confirmed a 16.5% fuel efficiency boost post-OTA for its fifth-gen DM PHEV tech. These developments, alongside XPeng's optimistic AI forecasts and crackdowns on network smear campaigns, signal China's EV giants accelerating toward AI-driven mobility dominance.

Xiaomi's MiMo-V2-Flash: Revolutionizing EV AI Agents

At the 2025 Xiaomi Human-Vehicle-Home Ecosystem Partners Conference on December 17, '95后 AI prodigy' Luo Fuli made her debut as head of Xiaomi's MiMo large model. She open-sourced MiMo-V2-Flash, a 309B parameter model with just 15B activated parameters, optimized for ultra-efficient inference.

Key highlights:

- Top-tier performance: Ranks #2 globally in code and agent benchmarks, surpassing larger models like DeepSeek V3.2.

- Agent-focused design: Excels in code/tool calling, high-bandwidth collaboration, and stable reinforcement learning.

- Vision for 'living' agents: Moves beyond 'language simulators' to agents with execution (memory, planning, decision-making) and omni-perception for real-world interaction in EVs and smart homes.

Luo emphasized: 'True intelligence is 'lived' through interaction,' positioning MiMo for seamless integration into Xiaomi's SU7 EV and beyond.

BYD's Dual Breakthroughs: L3 Testing and PHEV Efficiency

BYD is charging ahead on two fronts. First, it launched full-scale L3 autonomous driving internal tests in Shenzhen with local traffic authorities, covering high-speed roads in rain, night, and construction scenarios.

- Accumulated 15万+ km of real-road validation.

- Secured China's first L3 high-speed test license in July 2024.

- Part of national pilot with 9 firms including NIO, Changan, and GAC.

Second, fifth-gen DM PHEV OTA upgrade (rolled out October 13) delivered proven gains. Data from 100 Qin L owners across China showed:

| Scenario/Region | Pre-OTA Oil耗 (L/100km) | Post-OTA | Decline |

|---|---|---|---|

| City Roads | ~2.98 | 2.44 | 18% |

| Average | 3.27 | 2.73 | 16.5% |

| 黑龙江 (Coldest) | Highest baseline | -0.7L | 21%+ |

Factors: Temperature > battery state > altitude > congestion. Southern provinces like Guangdong hit lowest figures at ~2.4L/100km in亏电 mode.

XPeng's He Xiaopeng: No AI Bubble, Robots & L4 Ahead

XPeng Chairman He Xiaopeng dismissed AI hype on December 17, calling it a massive opportunity. Key predictions:

- Humanoid robots: Giant battleground; specialized bots to thrive in niches.

- Physical AI: Slower but transformative.

- Timeline: L4 autonomy in 3 years; humanoids from L1 to early L4.

- China focus: Practical apps vs. US research frenzy.

This aligns with industry shifts, as Tencent restructures for AI with ex-OpenAI star Yao Shunyu leading at up to 2x salaries.

Ideal, Xiaomi Fight Back Against Network Water Armies

Ideal Auto, Xiaomi, and Huawei reported organized smear campaigns. Shandong police busted a gang on December 17:

- 3,000+ fake negative articles via AI-generated spam.

- 12 arrested, 100万+ RMB seized, 8,000 accounts shut.

- Tactics: Keyword scraping for traffic/profit, targeting car quality and owners.

Ideal vowed legal defense for brand and users, underscoring fair play in China's cutthroat EV market.

Global Implications: Why This Matters for EV Future

China's EV leaders are fusing AI, autonomy, and efficiency at warp speed. Xiaomi's MiMo challenges global giants like Google's Gemini 3 Flash (81.2% MMMU-Pro score) and Tesla's Robotaxi (Morgan Stanley eyes 1,000 vehicles by 2026). BYD's feats bolster its 30%+ PHEV dominance amid Tesla's $1.5T+ valuation surge.

Competitive edge:

- Cost-efficient AI (MiMo's low-latency) for mass-market EVs.

- Real-world validation (BYD's 15万 km, 16.5% savings) over hype.

- Ecosystem plays: From XPeng robots to Tencent infra.

Looking Ahead: China's AI-EV Dominance

Expect MiMo integration in Xiaomi EVs by 2025, BYD L3 rollouts post-pilot, and intensified talent wars. As Tesla scales Cybercab, China's blend of affordable PHEVs, L3+ autonomy, and agentic AI positions it to capture global share—watch for OTA waves and robotaxi pilots reshaping urban mobility.

Original Sources

Related Articles

2025 China SUV Shakeup: Tesla Slips, Geely Surges Amid EV Shifts

Tesla Model Y holds China's 2025 SUV sales crown at 420K units despite 13% drop, as Geely's Xingyue L and Boyue L explode with 258K/257K sales via killer pricing and hybrids. BYD falters with 50%+ declines on key models, while Leapmotor C10 and Aito M8 emerge as EV stars; GAC's BU mergers signal traditional OEM reinvention. This shakeup underscores hybrids' resilience in the world's largest EV market.

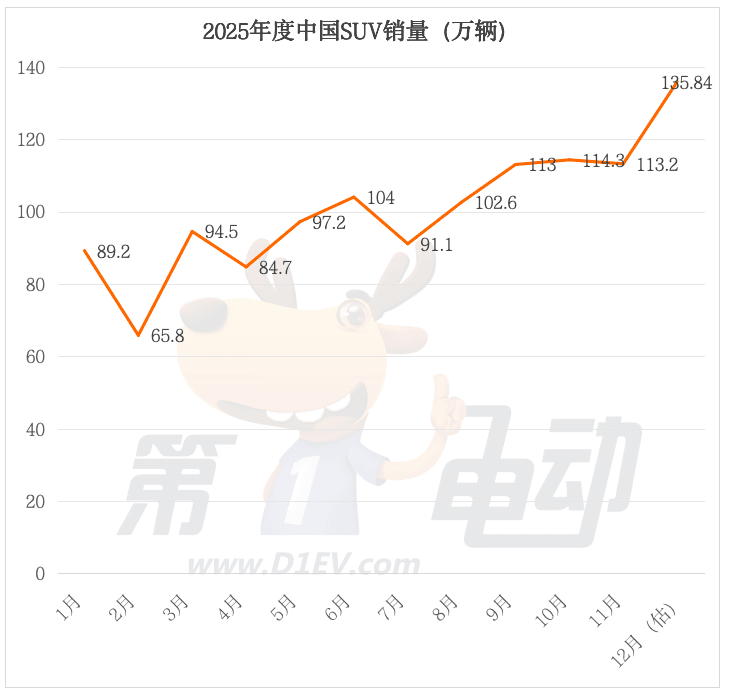

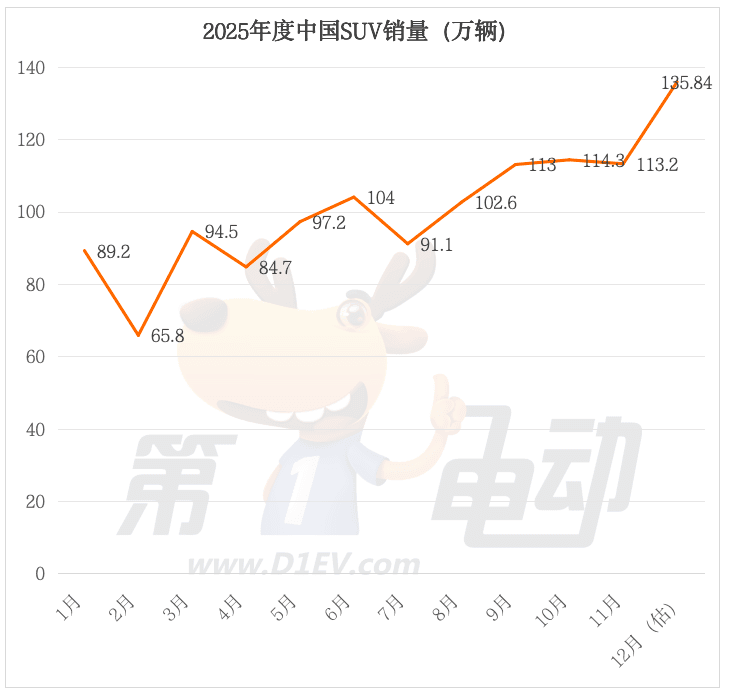

2025 China SUV Shakeup: Tesla Slips, Geely Surges

China's 2025 SUV market saw Tesla Model Y hold #1 at 420,000 units despite a 13% drop, while Geely's Xingyue L and Boyue L exploded to 2nd/3rd with 258k/257k sales. NEVs like Aito M8 and Leapmotor C10 rose as black horses, but BYD models halved; fuel/hybrids proved resilient in a 12.1M-unit market. GAC's reforms and global tech trends signal intensifying smart EV battles.