Chinese EVs Reshape Global Markets: India, Europe, Middle East

Chinese EVs drive global shifts: Maruti Suzuki's e VITARA eyes 45% alternative fuel share in India by 2027 with $28M infra push, as BYD/Chery claim 6.8% Europe market amid supplier layoffs. Faraday Future advances Middle East deliveries, underscoring China's ecosystem influence. EV penetration grows despite hurdles, forecasting 16% India sales rise in 2026.

Chinese electric vehicles (EVs) are accelerating their global dominance, influencing markets from India's booming alternative fuel sector to Europe's beleaguered suppliers and the Middle East's emerging EV hubs. Maruti Suzuki, India's largest automaker, plans to launch its first pure EV, the e VITARA, boosting its alternative fuel sales to 45% by 2026-2027, while European parts makers cry foul over Chinese competition. Meanwhile, Faraday Future advances Middle East deliveries amid Chinese brands' surging 6.8% European market share in October. This wave of developments underscores China's pivotal role in the EV revolution.

Maruti Suzuki Charges into India's EV Market with e VITARA

India's EV penetration stands at just 4.2% of passenger car sales, but Maruti Suzuki aims to electrify its dominance. The company, which holds a stronghold in India's mass market, will introduce the e VITARA—a global strategic pure EV—in early 2025 across over 100 cities.

- Sales Projection: Alternative fuel vehicles (currently 37% from CNG) to hit ~45% of total sales by FY 2026-2027 (April 2026-March 2027).

- Pricing and Range: UK export price starts at £26,249 (~$35,117); range 213-265 miles (battery-dependent), targeting 248-310 miles real-world in India.

- Target Audience: Premium positioning for young digital natives seeking upscale lifestyles.

To support this, Maruti has invested ~$28 million (25 billion INR) in infrastructure:

| Infrastructure Element | Scale |

|---|---|

| Company-owned chargers | 2,000+ in 1,000+ cities |

| Partnered chargers | ~12,000 via 13 operators |

| EV service centers | 1,500 locations |

Partho Banerjee, Maruti's marketing exec, emphasized ecosystem necessity: "Pushing a product without support invites backlash." By 2030, three more EVs are planned, targeting 15% EV penetration amid rivals like Tata, MG, and Tesla.

BloombergNEF forecasts 16% YoY EV sales growth in India's first three quarters of 2026, fueled by models like e VITARA.

European Suppliers Sound Alarm on Chinese EV Onslaught

As Chinese brands like BYD and Chery double their European share to 6.8% in October (Dataforce), suppliers like Gestamp and Valeo are reeling. Gestamp CEO Francisco Riberas urges EU short-term protections beyond current China EV tariffs, citing plunging West Europe revenues (Q3 down 7.4%, profits -21%) and auto output drops (Europe -4M vehicles vs. 2019, capacity -20%).

- Key Concerns: Flood of low-cost Chinese parts as Europeans cut costs; steel tariff proposals ignore vehicles/parts.

- Industry Pain: ZF plans 7,600 layoffs, Bosch 13,000; SMEs follow suit.

Valeo CEO Christophe Perillat echoes calls for "fair play," suggesting US IRA-style local value mandates. Yet Chinese firms focus on whole-vehicle exports, with localization nascent.

| Metric | China Brands Europe Oct 2024 | YoY Change |

|---|---|---|

| Market Share | 6.8% | Doubled |

| Gestamp W. Europe Q3 Revenue | Down 7.4% | N/A |

| Europe Auto Output vs 2019 | -4M vehicles | N/A |

Riberas views tariffs as a "defensive stopgap" while Europe restructures.

Faraday Future Expands in Middle East Amid Chinese Influence

Faraday Future (FF) delivers its FX Super One to Ras Al Khaimah Innovation City on December 22, building on a October strategic pact for EAI and smart mobility. FF's 108,000 sq ft regional hub supports FX/FF production, with Phase 2 expansion planned.

This follows the global first FX Super One handover to Andrés Iniesta in Dubai. New advisor Shahryar Oveissi bolsters investor ties, government affairs, and partnerships in Middle East, China, and North America—highlighting China's gravitational pull even for US startups.

Why This Matters: Global Implications for Chinese EVs

Chinese EVs aren't just vehicles; they're reshaping ecosystems. In India, they pressure incumbents like Maruti to electrify rapidly, addressing infra gaps that Chinese firms like BYD have mastered. Europe's pleas reveal vulnerabilities—Chinese pricing and scale erode local jobs/tech edges. FF's Middle East push shows China's supply chain enabling global plays.

Broader Trends:

- Indian EV growth despite slowdowns (post-tax cuts favoring small ICE cars).

- EU-China trade tensions escalate, potentially hiking barriers.

- Chinese dominance (BYD, Chery) forces adaptation worldwide.

Looking Ahead: China's EV Ascendancy Accelerates

Expect e VITARA to catalyze India's 16% EV surge in 2026, EU protectionism to test Chinese resilience, and Middle East hubs to proliferate. Chinese EV giants will likely deepen localization, outpacing rivals. For investors and enthusiasts, monitor policy shifts—China's battery/supply chain edge positions it to claim 20%+ global EV share by 2030.

Original Sources

Related Articles

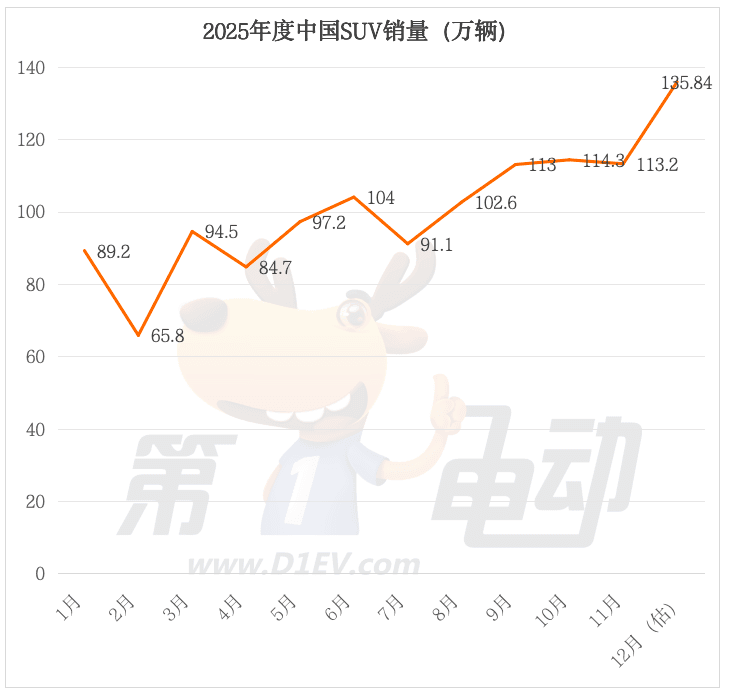

2025 China SUV Shakeup: Tesla Slips, Geely Surges

China's 2025 SUV market saw Tesla Model Y hold #1 at 420,000 units despite a 13% drop, while Geely's Xingyue L and Boyue L exploded to 2nd/3rd with 258k/257k sales. NEVs like Aito M8 and Leapmotor C10 rose as black horses, but BYD models halved; fuel/hybrids proved resilient in a 12.1M-unit market. GAC's reforms and global tech trends signal intensifying smart EV battles.

BYD Hits 15M NEVs, Leaks FCB Sedan as Momenta Eyes Global AD

BYD celebrates 15 million NEVs produced, outstripping Tesla and VW, fueled by hits like Dolphin and Seagull. Spy shots leak the FCB Magnesium 9 sedan with LiDAR for 2026, while Momenta bags Grab investment to push robotaxis in Southeast Asia. These moves spotlight China's EV production dominance and global AD expansion.