China's L3 Autonomous EVs Approved: Market Booms

China approves its first L3 autonomous EVs—Changan Deepal SL03 and Lynk & Co Alpha S—for Beijing and Chongqing pilots, as the unmanned driving market eyes 400B yuan in 2025. Domestic luxury brands like Aito and NIO crush BBA sales with higher average prices, while Huawei declares intelligence a faster-growing necessity than electrification. Tesla's unmanned tests and surging AI infra signal global autonomous EV acceleration.

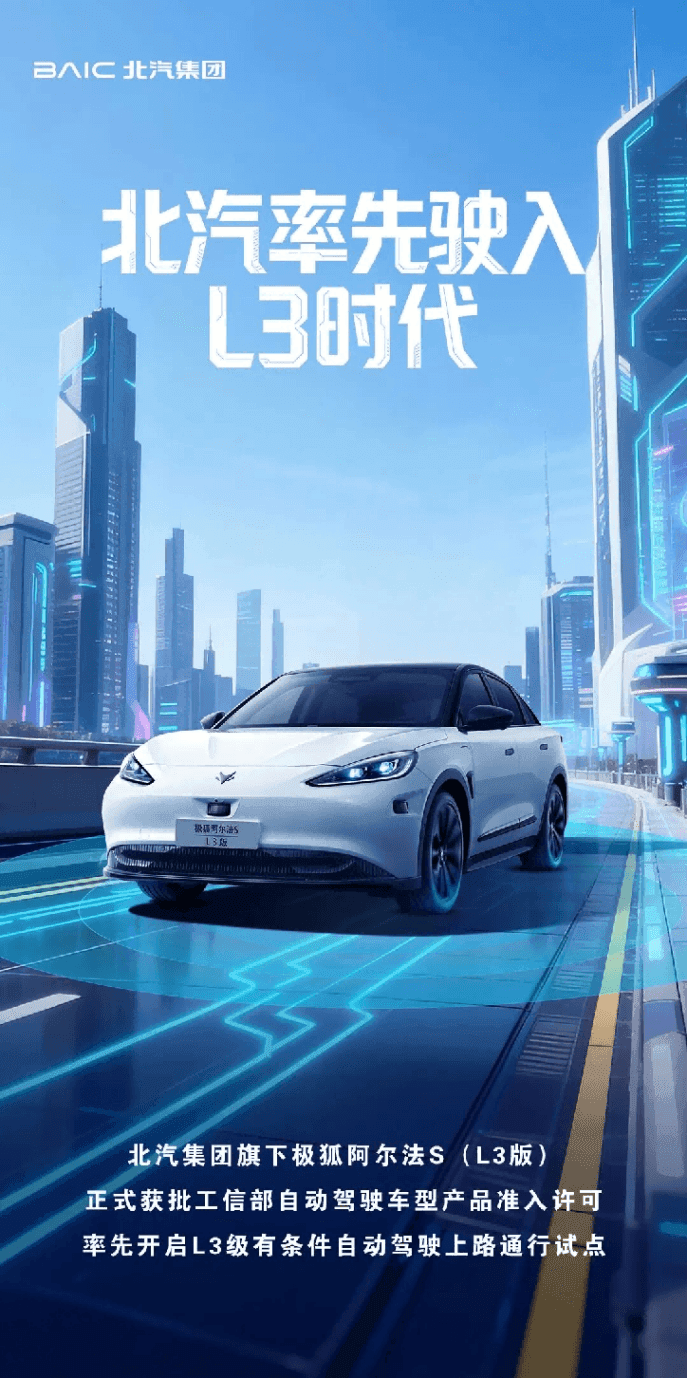

China has just greenlit its first L3-level conditional autonomous driving vehicles, marking a pivotal shift from testing to real-world roads. On December 15, the Ministry of Industry and Information Technology (MIIT) approved Changan Deepal SL03 and Lynk & Co Alpha S (L3 version) for pilot operations in Beijing and Chongqing. This comes amid explosive growth in China's unmanned driving market, projected to surpass 400 billion yuan in 2025, and surging sales of domestic luxury EV brands challenging BBA giants.

Breakthrough: China's First L3 Autonomous EVs Hit the Roads

The MIIT's approval for the Changan SC7000AAARBEV (Deepal SL03) and Lynk & Co BJ7001A61NBEV (Alpha S L3) signals China's leap into commercial L3 deployment. These pure electric sedans will pilot in designated zones:

| Model | Max Speed | Operational Areas | Key Capabilities |

|---|---|---|---|

| Deepal SL03 | 50 km/h | Chongqing specific roads (congestion, highways, urban expressways) | Single-lane autonomous driving in traffic |

| Lynk & Co Alpha S | 80 km/h | Beijing specific highways | Highway and urban expressway autonomy |

The Alpha S boasts 34 high-performance sensors, including 3 LiDARs, for 360° perception, full-chain redundancy inspired by aviation safety, and a traceable data logging system. Changan and Beijing出行汽车服务 will oversee pilots, with MIIT monitoring safety to refine regulations. This positions China ahead in Level 3 tech commercialization.

Unmanned Driving Market Explodes to 400B Yuan

China's autonomous sector is skyrocketing. Per Zhongshang Industrial Research:

- 2023: ~330 billion yuan, +14.1% YoY

- 2024: ~3,897 billion yuan

- 2025 forecast: >400 billion yuan

Meanwhile, Huawei's Jin Yuzhi highlighted intelligence surpassing electrification: L2 ADAS hit 50% penetration in new EVs in just 5 years vs. 10 for EVs. Huawei Qiankun ADS boasts 95% monthly active users, 5.8B km assisted driving, and 3.18M collisions avoided via CAS 4.0. Monthly deliveries of HarmonyOS Intelligent Mobility exceed 80,000 units, with Qiankun-equipped models topping 100,000.

Domestic Luxury EVs Crush BBA in China Sales

Chinese brands are dominating luxury EVs, eroding BBA (BMW, Mercedes, Audi) market share (Jan-Nov 2024 data):

| Brand/Group | Jan-Nov Sales | YoY Change | Avg Price (CNY) |

|---|---|---|---|

| BMW | 528,000 | -14.7% | - |

| Mercedes | 518,000 | -18.7% | - |

| Audi | 518,000 | -13.3% | - |

| Aito (Huawei) | 376,668 | + | 400,000 |

| NIO | 277,893 | +45.6% | 342,000 |

Aito leads with the highest average price at 400,000 yuan, followed by NIO. Zeekr, Li Auto, BYD's Denza/Tangwang, and Xiaomi are surging in the 200-350k yuan segment, once BBA's stronghold.

Global Echoes: Tesla Tests, AI Infra Booms

Tesla's driverless Model Y Robotaxis tested unmanned in Austin, eyeing full unsupervised rides by year-end. Elon Musk dismissed Earth-based fusion as "stupid," touting solar as a free reactor. Globally, Nebius (ex-Yandex) snagged $194B Microsoft and $30B Meta AI compute deals, leveraging 1,000 engineers for 2.5GW clusters by 2026—vital for autonomous AI training.

Why This Matters: Global Implications

China's L3 approvals and domestic EV surge underscore its EV leadership, with intelligence now a must-have faster than batteries. This pressures incumbents like BBA (Mercedes hiking India prices 2%) and accelerates global standards. Huawei's ecosystem (200k parking spots, 1.4M chargers) exemplifies open platforms driving adoption.

Looking Ahead

Expect rapid L3 expansion, more pilots, and intensified competition. With Purple Light Microelectronics' new AI chip institute targeting autonomous driving, China's edge in end-side AI sharpens. Investors and buyers: Domestic luxury EVs like NIO and Aito offer premium autonomy at scale—watch 2025 for mass L3 rollouts reshaping mobility worldwide.

Original Sources

Related Articles

China's Used EV Boom Meets Global Shifts: Key News

China's used NEV market soared to 829,000 trades in Jan-Jul 2025 (+39.1% YoY), fueled by Cha Boshi's battery detection services easing buyer fears. Globally, Ford cuts $19.5B in EV plans amid demand woes, while Musk's wealth tops $677B on Tesla's rally and SpaceX buzz. This divergence spotlights China's EV dominance in a shifting landscape.

China EV News: XCU Hits 500K, L3 Approval, Power Deals

China's EV sector surges with Jingwei Hengrun's XCU hitting 500K units on Geely Xingyuan, MIIT approving two L3 autonomous models from Changan and BAIC BluePark, and Dongan Power's strategic lab with BAIC Manufacturing for off-road NEVs. These breakthroughs tackle wiring costs, boost autonomy, and enhance powertrains amid 2024's 9.5M NEV output. They solidify China's lead in software-defined vehicles and global EV competition.