2025 China SUV Shakeup: Tesla Slips, Geely Surges

China's 2025 SUV market saw Tesla Model Y hold #1 at 420,000 units despite a 13% drop, while Geely's Xingyue L and Boyue L exploded to 2nd/3rd with 258k/257k sales. NEVs like Aito M8 and Leapmotor C10 rose as black horses, but BYD models halved; fuel/hybrids proved resilient in a 12.1M-unit market. GAC's reforms and global tech trends signal intensifying smart EV battles.

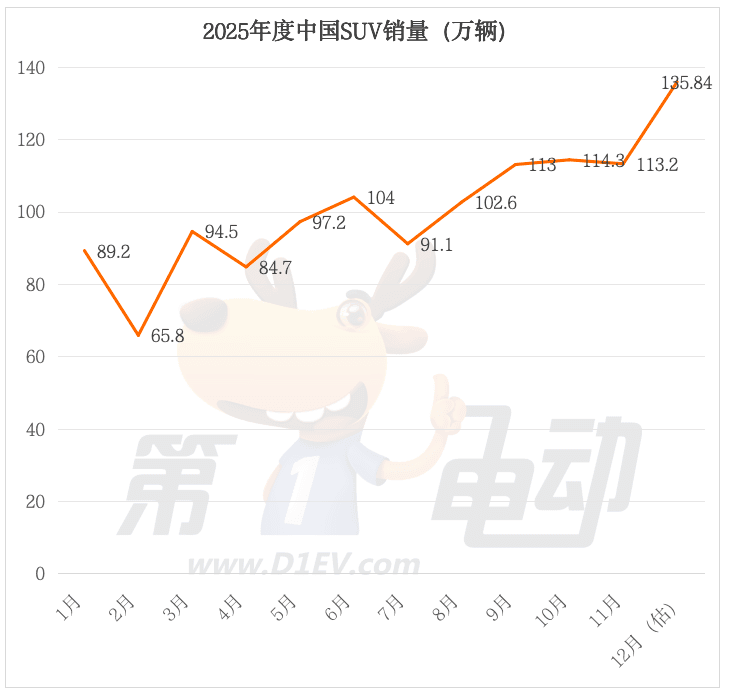

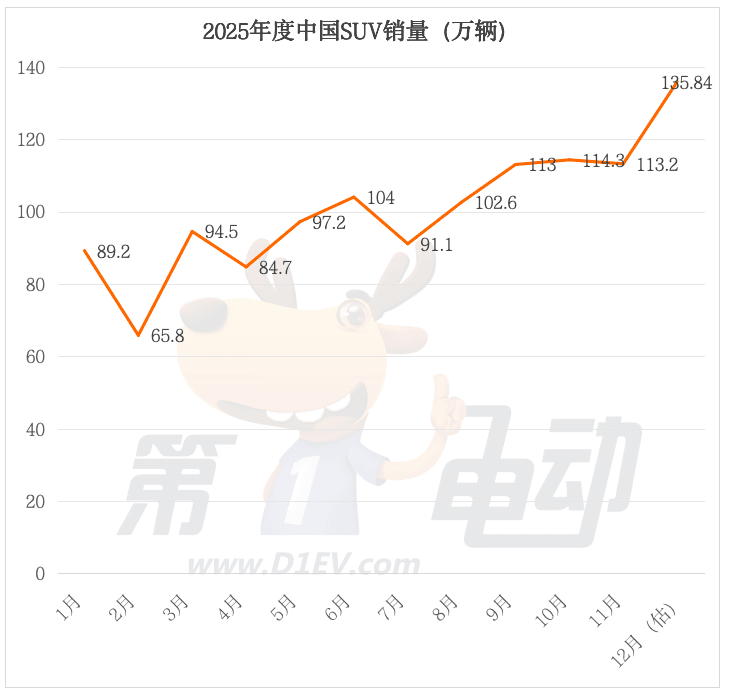

In 2025, China's SUV market underwent a dramatic restructuring, driven by surging new energy vehicle (NEV) adoption and shifting consumer preferences. Tesla's Model Y clung to the top spot with an estimated 420,000 units sold but faced a 13% year-over-year (YoY) decline amid fierce domestic competition. Geely's fuel-powered Xingyue L and Boyue L countered with explosive growth, securing 2nd and 3rd places at 258,000 and 257,000 units respectively, while NEV dark horses like Aito M8 and Leapmotor C10 disrupted the leaderboard. Retail SUV sales hit 10.696 million units in January-November, up 5.7% YoY, with full-year projections nearing 12.1 million.

Headliners Reshuffle: Model Y Under Pressure, Geely's Fuel Duo Strikes Back

Tesla Model Y's reign as China's top SUV persisted, but its slippage highlights intensifying rivalry. New model transitions created delivery delays, while rivals like BYD, Aito, and Leapmotor matched or exceeded its intelligence, range, and pricing in the 200,000-300,000 RMB segment. Domestic brands eroded Tesla's edge with superior service and localized features.

Geely bucked the NEV trend spectacularly:

- Xingyue L: 258,000 units (+17% YoY), priced from ~160,000 RMB post-discount, boasting dual screens and L2 ADAS.

- Boyue L: 257,000 units (+121% YoY), starting at ~90,000 RMB, targeting budget families with mid-size perks.

These fuel/hybrid models thrived on affordability, reliability, and no range anxiety, proving ICE and PHEV resilience.

NEV Divide: Winners Emerge, BYD Stumbles

China's NEV SUVs showed stark polarization. New entrants shone:

| Model | Est. 2025 Sales | Key Specs | YoY Change |

|---|---|---|---|

| Aito M8 | 150,000 | HarmonyOS cockpit, dual-motor AWD, 36-45万 RMB | New black horse |

| Leapmotor C10 | 140,000 | 2825mm wheelbase, 1190km range (EREV), LiDAR | +Rapid rise |

BYD's stalwarts faltered:

- Song PLUS and Yuan PLUS: Sales halved (>50% drop), hit by aging lineups, price wars, and internal cannibalization (e.g., Sea Lion 06).

- Yuan UP bucked the trend (+45% YoY) via urban mini-SUV appeal.

Joint-venture holdouts like VW Tiguan L (205,500 units, +20%) and Toyota RAV4 (219,000, +13%) retained loyalists with proven durability.

Top 20 Shifts: Lower Concentration, Fuel's Comeback

The 2025 SUV Top 20 featured only 8 NEVs (down from 9 in 2024), with their share slipping 6% to 3.9 million units. Front-10 saw massive turnover: 2024 leaders like Yuan PLUS and Song Pro tumbled, replaced by 4 fuel models including Geely duo, VW Tiguan L, and Chery Tiggo 8.

- 本土 brands: 12 models (up 1 YoY), led by Geely, BYD, Changan.

- JVs: Down to 7, but Toyota RAV4 jumped to #4.

This signals NEV maturation pains and fuel/hybrid staying power amid infrastructure gaps.

Broader Tech & Industry Trends

Parallel to market flux, global auto tech advanced intelligent connectivity:

- Seeing Machines' 'attention sharing' for driver distraction in fleets.

- Micron's UFS 1 flash (2GB/s) for ADAS/AI data needs.

- HERE's SDV maturity framework, mapping OEMs' software shift.

In China, GAC's 'Panyu Action' counters sales woes (2025 H1 loss: 2.538B RMB) via BU reforms merging Haobo and Aion under one unit, channel fusion (1,000+ stores by 2026), and Huawei JV 'Qijing' for 300,000+ RMB smart EVs in 2026.

Why This Matters: Global Implications

China's 21.464 million passenger vehicle sales (Jan-Nov, +29% YoY) underscore its EV dominance, with SUVs at 50% share. Fuel resurgence challenges full electrification narratives, signaling hybrids as a bridge. For globals like Tesla, it demands sharper localization; for Western OEMs, emulating Geely's value play is key. GAC's reforms highlight legacy giants' pivot to partnerships (e.g., Huawei) amid NEV intelligence races.

Looking Ahead

2026 eyes NEV rebound via tech leaps—LiDAR ubiquity, 800V platforms, SDV ecosystems. Watch Geely's hybrid push, BYD refreshes, and GAC's Qijing debut. China's SUV arena remains a proving ground for EV evolution, blending green ambition with pragmatic consumer needs.

Original Sources

Related Articles

2025 China SUV Shakeup: Tesla Slips, Geely Surges Amid EV Shifts

Tesla Model Y holds China's 2025 SUV sales crown at 420K units despite 13% drop, as Geely's Xingyue L and Boyue L explode with 258K/257K sales via killer pricing and hybrids. BYD falters with 50%+ declines on key models, while Leapmotor C10 and Aito M8 emerge as EV stars; GAC's BU mergers signal traditional OEM reinvention. This shakeup underscores hybrids' resilience in the world's largest EV market.

BYD Hits 15M NEVs, Leaks FCB Sedan as Momenta Eyes Global AD

BYD celebrates 15 million NEVs produced, outstripping Tesla and VW, fueled by hits like Dolphin and Seagull. Spy shots leak the FCB Magnesium 9 sedan with LiDAR for 2026, while Momenta bags Grab investment to push robotaxis in Southeast Asia. These moves spotlight China's EV production dominance and global AD expansion.