岚图追光L Shocks with 800V PHEV Tech Amid Trade Tensions

岚图's new 追光L 800V PHEV sedan launches at 27.99-30.99万元, crushing BBA rivals with 410km EV range, -25°C fast charging, and Huawei ADS 4.0. Xiaomi adds discounted 'quasi-new' SU7s ahead of 2025 NEV tax cuts, while Mexico slaps 50% tariffs on Chinese EVs, threatening export growth. These moves highlight China's tech edge amid rising global trade barriers.

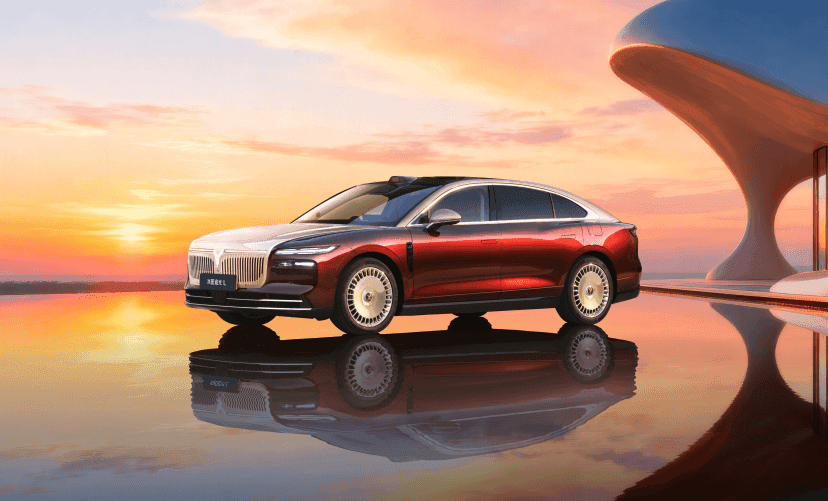

On December 12, 2024, Chinese luxury EV brand岚图 (Lantu) launched its flagship 800V plug-in hybrid sedan, the 追光L (Zhuguang L), priced at 27.99-30.99万元 ($38,500-$42,700 USD). This mid-to-large luxury PHEV boasts extreme cold-weather charging prowess and superior specs over German rivals like Mercedes-Benz E-Class and Audi A6L PHEVs. Meanwhile, Xiaomi expands its SU7 lineup with 'quasi-new' cars, and Mexico's new tariffs threaten Chinese EV exports, signaling rising global trade hurdles for China's booming auto sector.

岚图追光L: Redefining Luxury PHEV Performance

The 追光L targets premium buyers with cutting-edge tech, positioning itself against BBA (BMW, Benz, Audi) icons. Lantu's VP of Sales, Li Boxiao, boldly claimed it surpasses traditional luxury brands in chassis control, with 'generational leaps' in battery, electric drive, and intelligence.

Key highlights from the launch:

- Powertrain: 800V smart hybrid system paired with a 63kWh ternary lithium battery.

- Range: 410km pure electric (CLTC), up to 1400km comprehensive—dwarfing Mercedes E-Class PHEV's 100+km and discontinued Audi A6L's 50km.

- Extreme Cold Charging Test: At -25°C after 8-hour static rest, it charged from 20% to 80% in just 12:38 minutes—only 30 seconds slower than room temperature.

| Feature | 岚图追光L | Mercedes E-Class PHEV | Audi A6L PHEV (discontinued) |

|---|---|---|---|

| Pure EV Range (CLTC) | 410km | ~100km | 50km |

| Battery Capacity | 63kWh | ~25kWh | ~14kWh |

| Voltage Platform | 800V | 400V | 400V |

| Comprehensive Range | 1400km | ~1000km | ~800km |

This cold-weather resilience is crucial as Northern China's NEV penetration rises, making low-temp performance a key battleground.

Intelligence That Leaves BBA in the Dust

Full-series Huawei Qiankun ADS 4.0 intelligent driving with 29 high-performance sensors enables full-scenario human-vehicle collaboration. HarmonyOS 5 cockpit features super desktop integration (seamless phone-car syncing) and continuous AI voice commands.

- BBA PHEVs require 2-3万元 extra for limited ADAS packages; 追光L includes it standard.

- 29 sensors vs. rivals' basic kits—true 'generational lead' in autonomy.

Buyers get 5.2万元 launch incentives, sweetening the deal in a competitive luxury PHEV market.

Xiaomi's 'Quasi-New' SU7 Strategy Boosts Accessibility

Shifting gears, Xiaomi Auto added 'quasi-new' SU7 cars on December 12—original new vehicles with minor transport-related repairs, rigorously inspected and backed by full factory warranty. CEO Lei Jun clarified: "We didn't invent 'quasi-new'; we're just using the industry's term."

- Perks: Fast delivery (by end-2025 for orders before Dec 26), original warranty, discounts on select models.

- Timing: Aligns with China's NEV purchase tax halving from Jan 1, 2025 (from full exemption), fueling year-end sales surge.

This move expands access to Xiaomi's hot SU7 amid booming demand.

Mexico's Tariffs Hit Chinese EVs Hard

Global headwinds loom: Mexico's Senate approved 5-50% tariffs on 1400+ Asian imports (effective 2025), with Chinese cars facing up to 50%. China holds 20% Mexican auto market share (up from negligible six years ago).

- Rationale: Protects local industry, mirrors U.S. trade barriers under Trump; expected to generate $2.8B revenue.

- China's Response: Commerce Ministry urges correction, ongoing trade barrier probe; potential retaliation on Mexican copper.

- Context: Mexico's President Sheinbaum denies anti-China intent but aligns with U.S./Canada EV tariffs.

Why This Matters: Global Implications for Chinese EVs

These developments underscore China's EV dominance—岚图's tech leap challenges BBA luxury stronghold, Xiaomi innovates sales amid policy shifts, but Mexico's tariffs (plus U.S./EU duties) curb export growth. Chinese brands now command 20% in Mexico, but protectionism could redirect focus to domestic/BRICS markets. With NEV tax changes sparking China sales peaks, expect intensified cold-weather R&D and supply chain resilience.

Looking Ahead

岚图追光L could redefine PHEV luxury if deliveries match hype, Xiaomi's quasi-new push sustains SU7 momentum into 2025, and trade wars may accelerate Chinese EV localization abroad. Watch for retaliatory measures and Q1 sales data—China's EV surge shows no signs of slowing.

Original Sources

Related Articles

China EV News: XCU Hits 500K, L3 Approval, Power Deals

China's EV sector surges with Jingwei Hengrun's XCU hitting 500K units on Geely Xingyuan, MIIT approving two L3 autonomous models from Changan and BAIC BluePark, and Dongan Power's strategic lab with BAIC Manufacturing for off-road NEVs. These breakthroughs tackle wiring costs, boost autonomy, and enhance powertrains amid 2024's 9.5M NEV output. They solidify China's lead in software-defined vehicles and global EV competition.

Chinese EVs Dominate: Record Sales, AI Advances & Factory Milestones

Global EV sales smashed records at 2 million units in November 2025, with China's 1.32 million dominating amid BYD export highs and Tesla Shanghai's 400 millionth car. Funding surges for Deepal (6.12B RMB) and JAC (3.5B RMB) fuel smart platforms, while AI advances like DeepMind's 2028 AGI odds and具身智能 breakthroughs promise L4 'space robots.' EU price talks ease tariff fears, positioning Chinese EVs for global leadership.